There are many tax receipts that you should retain. At least for the time being.

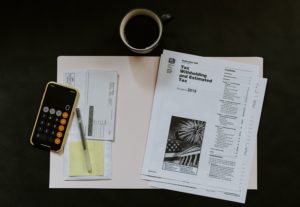

Keeping tax receipts sounds pointless. However, it’s much more important to hang onto the documents you’ll need when tax time rolls around. In some cases, there are plenty of copies that you won’t have to keep if they are no longer valid. That said, some paperwork will help you fill out your tax forms as efficiently as possible. Read on to learn more.

Documentary Evidence You Need to Keep

There are many tax receipts that you should retain. At least for the time being. That’s because the IRS requires you to furnish so-called “documentary evidence” regarding tax credits and deductions. Those expenses are highly specific and include the following items:

- Charitable contributions

- Medical bills

- Travel/transportation receipts for medical appointments and treatments

- Weight-loss program bills

- Office expense receipts

While there are many important receipts, these are the most notable examples that you should track down and organize, so nothing slips through the cracks.

The Receipts You Won’t Need

Getting rid of the receipts you no longer need isn’t as simple as it sounds. One unfortunate reality of this aspect of recording taxes is that not much counts. On the other hand, client entertainment and overnight travel are minor exceptions. Expenses below $75 are considered unimportant; lodging receipts are not. You should keep those so you can track your cash flow in both directions.

Pertinent Information and Details

Information is knowledge. Knowledge is power. Every receipt you catalog needs to include amounts, dates, places, and type of expense. Other evidence such as canceled checks and credit card bills are also helpful. That said, they must be related to business transactions to count.

Scanned Versions and Photographic Images

Since digital filing is convenient, old-school tax completion methods are beginning to disappear. As such, electronic submissions are the way to go. They are easier and faster to deal with and will make your CPA’s job easier to boot.

Trust the Professionals at the Harding Group

Unlike other accounting firms, The Harding Group, located in Annapolis, MD, will never charge you for consultations and strive for open communication with our clients.

Are you interested in business advising, tax preparation, bookkeeping and accounting, payroll services, training + support for QuickBooks, or retirement planning? We have the necessary expertise and years of proven results to help.

We gladly serve clients in Annapolis, Anne Arundel County, Baltimore, Severna Park, and Columbia. If you are ready to take the stress out of tax time, contact us online or give us a call at (410) 573-9991 for a free consultation. For more tax tips, follow us on Facebook, Twitter, YouTube, and LinkedIn.

Back

Back