COVID-19 Notice

| It’s now been 2 weeks since the second stimulus bill was passed by Congress, and, as you know, questions still abound! I am continuing to scour the internet for answers – answers that can be verified by a reliable source, preferably a government source. More than once I have prepared an email blast only to decide not to send it because I found conflicting information.

I know this information is daunting. I’ve tried to simplify it, but there’s nothing simple about it. So, take your time and read through carefully. Please follow the links for more information. Please pay special attention to anything marked NEW. |

|

|

HIGHLIGHTS OF THE CARES ACT

|

|

|

Information for Individuals AND Self-Employed People

- Free Money Coming! (also known as the Economic Impact Payment) Individuals with adjusted gross income under $75K will receive a one-time payment of $1,200. That’s $2,400 for a couple with income under $150K. And – you get $500 per kid! It’s based on your 2019 tax return, or your 2018 tax return if you haven’t filed 2019 yet.NEW: Most people don’t need to do anything. But, if you haven’t filed 2018 or 2019 and you believe you are eligible for the payment, or if the IRS doesn’t have your bank info from your last tax return, go here to speed up your payment Click for all the details.

- Unemployment Benefits – much more generous and now self-employed people are eligible! This is great news for a lot of people.

- The Federal government will pay $600 per week! Each state will continue to pay unemployment to people who qualify and the Federal government will kick in an additional $600 per week through the end of July 2020.NEW: Unfortunately, the states haven’t been able to keep up with the huge volume of claims, and the Federal money doesn’t seem to be flowing yet. Keep trying! You will be paid in full. As far as I can tell, if you are self-employed you will receive $600 per week even if your SE income was lower than that on your last tax return. If it was a loss, though, I don’t know if you’ll qualify. (I’m not sure what documentation you’ll need to provide to prove that you were self-employed.)There’s lots of good information, including a helpful Q&A page on the MD site. If you are filing for MD unemployment, start by reading: MD Unemployment Claims.

- No Penalties for Taking an Early Withdrawal from Retirement. The 10% early withdrawal penalty is waived for distributions of up to $100K made before the end of the year if you qualify. And you can pay the taxes over 3 years. To qualify, you or a family member had to be diagnosed with COVID-19, or you had to suffer adverse financial consequences. (I’m sure “adverse financial consequences” will be better defined.)

- Improvements to Health Insurance.

- COVID-19 Testing, Treatment, and Vaccines will be Covered by Health Insurance.

- High Deductible Health Plans are allowed to cover telehealth and other remote care services without charging a deductible

- Employers can Help with Student Loans. Employers can pay up to $5,250 in tax-free student loan repayment benefits.

- Student Loans on Pause. All student loans and interest payments will be deferred through 9/30/2020.

|

|

|

Information for Small Businesses (less than 500 employees)

- The Federal government will advance the payroll tax credits enacted in the Families First Act. You may recall that the Families First Act requires businesses with less than 500 employees to pay 2 weeks of paid sick time and then up to another 10 weeks of paid leave, all of which is going to be refunded in full by the Federal government. The CARES Act allows the refunds to be advanced instead of reimbursed “using forms and instructions the IRS will provide.”NEW: The IRS has created a new Form 7200 “Advance Payment of Employer Credits Due to COVID-19.” This form allows you to request an advance for the Employee Retention Credit and/or Paid Sick Leave and/or Extended Family Medical Leave. (More info below on the Employee Retention Credit and the Families First Act)

- Employers can defer their share of FICA. The employer portion of Social Security and Medicare (generally 7.65%) can be deferred for the rest of this year. Half of the deferral amount would be due 12/31/2021 and the other half would be due 12/31/2022.NEW: This deferral is not available to employers receiving loan forgiveness through a PPP loan.

- 50% Payroll Tax Credit on the first $10,000 of wages for each employee. (also known as the Employee Retention Credit) FICA is 7.65% so that’s a credit of about $765 per employee. This is available to employers who suffered due to the virus and had gross revenues drop by 50% or more compared to the same quarter last year.NEW: This deferral is not available to employers receiving loan forgiveness through a PPP loan. For all the details read more on the Employee Retention Credit

|

|

|

HIGHLIGHTS OF THE FAMILIES FIRST CORONAVIRUS RESPONSE ACT

|

|

|

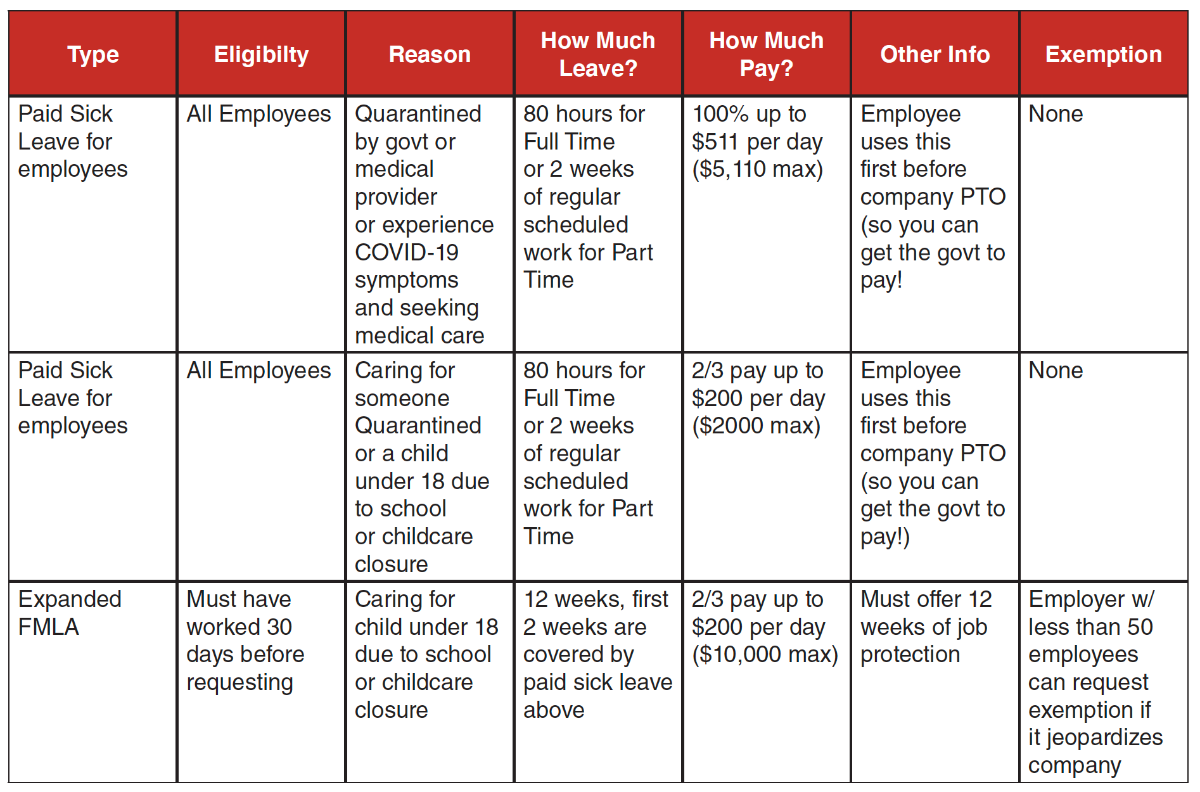

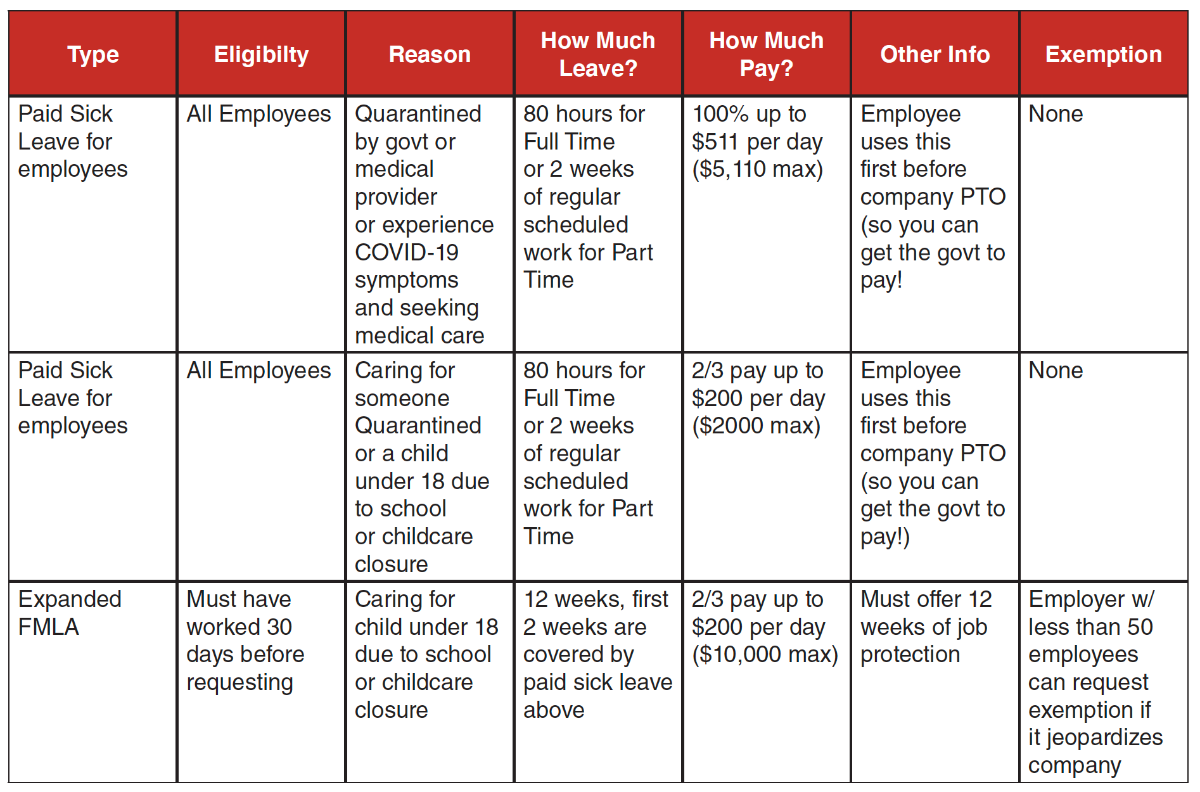

This information only applies to businesses with less than 500 employees.

- The effective date is April 1, 2020.

- The Emergency Paid Sick Leave Act requires employers to pay 80 hours of paid sick leave, which the Federal government will now advance in full.NEW: The IRS has created a new Form 7200 “Advance Payment of Employer Credits Due to COVID-19”. This form allows you to request an advance for the Employee Retention Credit and/or Paid Sick Leave and/or Extended Family Medical Leave.

- The Emergency Family Medical Leave Expansion Act requires employers to provide an additional 10 weeks of paid leave (at 2/3rds pay) to employees who have been employed for 30 days. The Federal government will now advance the funds in full. NEW: The IRS has created a new Form 7200 “Advance Payment of Employer Credits Due to COVID-19.” This form allows you to request an advance for the Employee Retention Credit and/or Paid Sick Leave and/or Extended Family Medical Leave.NEW: Please understand that there are 3 types of payments under the Families First Act:

- Your employee is sick or quarantined

- Your employee is caring for someone sick/quarantined and/or a child under 18 due to school or child care closure

- Your employee is caring for a child under age 18 due to school or childcare closure. (yes – this overlaps with line 2)

Read all the details and the frequently asked questions on the Families First paid leave.

Please see the table below to understand how much the employee must be paid (credit: Payroll Services LLC.)

|

|

|

HIGHLIGHTS OF THE MARYLAND COVID-19 PROGRAMS

|

|

|

These programs only apply to businesses with employees on payroll.

- MD $10K Grant: also known as the MD Small Business COVID-19 Emergency Relief Grant Fund. This is free money. If you qualify and you haven’t applied yet, you should hurry.NEW: MD is no longer accepting applications

- MD $50K Grant: also known as the COVID-19 Layoff Aversion Fund – Workforce and Development and Adult Learning. This is free money. If you qualify and you haven’t applied yet, you should hurry.NEW: MD is no longer accepting applications

- MD $50K Loan: also known as the MD Small Business COVID-19 Emergency Relief Grant Loan. This loan has 0% interest for the first 12 months and then 2% for the remaining 24 months (36 months total). This seemed like a really good deal until the Fed offered loans that can be forgiven.NEW: MD is no longer accepting applications

|

|

|

NEW: HIGHLIGHTS OF THE SBA PROGRAMS

|

|

|

- Paycheck Protection Program: This program is designed to help small businesses keep employees on payroll, but it’s also available to self-employed people without a payroll. The amount of the loan is based on average monthly payroll, and the amount forgiven is based on your spending the 8 weeks after you receive the funds. (You apply on your bank’s website.)This program is live! The first round of funding has already run out and the banks are overwhelmed, so don’t wait any longer. This updated brochure tells you how much you can borrow and how much will be forgiven.

- EIDL Loan Advance: This is a $10K advance on an SBA loan or a PPP loan that does not have to be repaid. The EIDL advance reduces the amount of your PPP loan or SBA loan. There have been problems with the EIDL applications too, so I don’t know if you are likely to receive the EIDL faster than the PPP proceeds. More info on EIDL Emergency Advances.

- SBA Express Bridge Loan: This program allows small businesses that currently have a business relationship with an SBA Express Lender to access up to $25K quickly.

- SBA Economic Disaster Loans: The SBA is also giving loans to help small businesses get through the crisis. Look for a checkbox on the loan application that asks if you want the $10K advance that you don’t have to pay back. (They changed the app so I’m not sure if it’s still there.)

|

|

|

OTHER THINGS YOU SHOULD KNOW

|

|

|

- Taxes are due July 15th instead of April 15th. You can file and pay as late as July 15th without an extension.

- 1st quarter estimated tax payments are also due July 15 instead of April 15.

NEW/CORRECTION: DC has not changed the date of their estimated tax payments. They are still due 4/15, 6/15, 9/15, 1/15. (My previous newsletter said that taxes were still due April 15 and that’s incorrect. The tax return and tax payment for 2019 is due July 15.)

- NEW: 2nd quarter estimated tax payments are now due July 15 instead of June 15. So both Q1 and Q2 estimates are due July 15.

- IRA and HSA contributions are due July 15.

- NEW: Required Minimum Distributions are not required for 2020!

- NEW: MD Personal Property Returns are now due July 15.

- NEW: Evictions of both residential and commercial tenants are temporarily prohibited, as are foreclosures. See the Governor’s order. There’s a Virtual Town Hall for tenants and landlords on Monday 4/13 at 7:00pm.

- MD sales taxes that are due in March, April or May can be paid by June 1st and still be considered on time (no penalties or interest will be applied). Please let us know if you would like us to not pay your sales tax.

- MD withholding taxes (for employers) that are due in March, April or May can be paid by June 1 and still be considered on time (no penalties or interest will be applied). However – we are currently unable to take advantage of this because the payroll software companies have not yet been able to adapt the software to allow for this change. We will let you know as soon as the feature is available.

- The IRS has suspended collection efforts and suspended installment plan payments from April 1 through July 15 (but by law, interest continues to accrue). More info here.

- The IRS has closed its Tax Practitioner Priority Line. This is the department we CPAs call when we have a power of attorney form for a client and need answers. It’s too bad it’s closed.

- Some lenders are suspending payments for mortgages, autos and credit cards. Do not hesitate to reach out to your lender and ask if a payment deferral is available (before you spend your last dollar). I understand a number of commercial landlords are also making accommodations in light of the pandemic, but you probably have to ask.

- NEW: While our office is closed anyway, due to the pandemic, please note that we will be off on Friday, April 17. It has been our tradition to close the Friday after April 15 and we decided we could all use a break!

|

|

|

| That’s it for now! Please reach out to us by email if we can be of any help. I’m doing my best to keep up with emails and phone messages, but after we send out a blast, I get inundated. That’s ok – I want to help you. I’ll get back to you as soon as I can.

If you are looking for an easy way to give back during this crisis, may I suggest giving blood at AAMC?

Feel free to share this newsletter.

Stay healthy and stay home!

Marla |

|

|

Contact Us:

410-573-9991 + Marla@TheHardingGroup.biz

2014 Industrial Drive

Annapolis, MD 21401

(off of Bestgate Road, behind the Annapolis mall) |

|

|

Our office is closed. We are all working from home until further notice. The best way to reach us is by email. If you are checking on the status of your tax return, or aren’t sure who to contact, please email jacqui@thehardinggroup.biz.

Copyright © 2020 The Harding Group, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

Back

Back